You can operate your small business in several ways. For example, your entity can be a sole proprietorship, an S corporation or a partnership. Here are the advantages of operating as a limited liability company (LLC).

Posted on August 9, 2023 by CD Bradshaw & Associates, P.C.

You can operate your small business in several ways. For example, your entity can be a sole proprietorship, an S corporation or a partnership. Here are the advantages of operating as a limited liability company (LLC).

Posted on July 31, 2023 by CD Bradshaw & Associates, P.C.

Some taxpayers can look forward to receiving transitional relief from the IRS related to the required beginning dates for taking required minimum distributions from retirement plans.

Posted on July 27, 2023 by CD Bradshaw & Associates, P.C.

There may be a way to reduce a large tax bill if you own appreciated land that you want to subdivide and develop for sale. Here’s a three-step strategy.

Posted on July 24, 2023 by CD Bradshaw & Associates, P.C.

When spending money personally on behalf of your closely held corporation, you want to ensure the expenses are tax deductible by either you or the business. Here are the key considerations.

Posted on June 28, 2023 by CD Bradshaw & Associates, P.C.

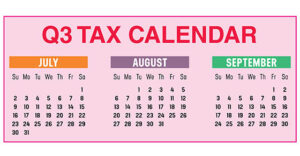

You might want to enjoy the lazy days of summer, but employers and businesses need to make sure not to miss these third-quarter 2023 tax deadlines.

Posted on June 21, 2023 by CD Bradshaw & Associates, P.C.

If you do business with virtual currency, it’s time to bone up on related tax requirements. The IRS is paying closer attention.

Posted on June 21, 2023 by CD Bradshaw & Associates, P.C.

Most people, including construction business owners, feel a sense of relief when their taxes are filed. But contractors need to make tax planning a year-round activity. Here are some Q&As to consider.

Posted on June 12, 2023 by CD Bradshaw & Associates, P.C.

Here’s a rundown of the tax deductions you can claim for business travel.

Posted on June 7, 2023 by CD Bradshaw & Associates, P.C.

Keeping careful business records for meal and vehicle expenses can safeguard your tax deductions. Here are some DOs and DON’Ts.