Summer is here and tax deadlines are probably the last thing on your mind. But there are some important third-quarter deadlines that businesses can’t afford to forget about.

Posted on June 27, 2024

Summer is here and tax deadlines are probably the last thing on your mind. But there are some important third-quarter deadlines that businesses can’t afford to forget about.

Posted on June 19, 2024

There are several factors to consider when converting from a C corporation to an S corporation. Here are four of the tax issues you may face.

Posted on April 1, 2024

Spring is here, along with a bunch of tax-related deadlines. Here are some upcoming dates for the second quarter of 2024 that businesses and employers should keep in mind.

Posted on February 21, 2024

Many businesses have a choice of using cash or accrual accounting for tax purposes. If you’re one of them, which route should you take? Here are the rules.

Posted on February 7, 2024

Aggressive marketing encouraging businesses to claim the pandemic-related Employee Retention Tax Credit led to many taxpayers erroneously receiving refunds. The IRS has a program that allows them to come forward and repay part of the money before collection efforts begin.

Posted on January 2, 2024

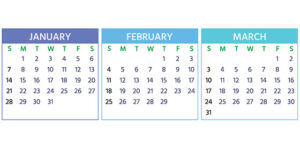

In the first quarter of 2024, businesses face several tax-related deadlines. Here are some key due dates and obligations.

Posted on December 11, 2023

The holiday whirlwind has begun. There may be ways your small business can save on 2023 taxes. But you must act fast.

Posted on November 16, 2023

Choosing the best entity for your business is a multi-faceted decision. Here’s a look at the some of the considerations.

Posted on October 26, 2023

Complex calculations are involved in claiming depreciation deductions for the business use of a passenger automobile. Here are the basic rules.