Now is the time to get up to speed on 2024 SECURE 2.0 changes. Here are several to consider.

Posted on June 25, 2024

Now is the time to get up to speed on 2024 SECURE 2.0 changes. Here are several to consider.

Posted on May 8, 2024

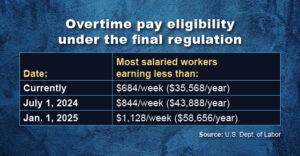

Two new federal rules regarding overtime pay and noncompete agreements have recently been adopted.

Posted on April 26, 2024

If you’ve inherited an IRA, you need to know about the latest IRS guidance.

Posted on April 17, 2024

The IRS has offered guidance regarding the tax treatment of energy efficiency rebates introduced by the Inflation Reduction Act.

Posted on March 19, 2024

President Biden has laid out his proposals for tax law changes in the fiscal year 2025 budget.

Posted on February 27, 2024

The deadline to comply with a new U.S. Dept. of Labor rule regarding worker classification is fast approaching. Is your company ready?

Posted on January 23, 2024

The IRS’s new Voluntary Disclosure Program may provide employers relief from penalties related to ineligible Employee Retention Tax Credit claims.

Posted on January 22, 2024

Reference this tax calendar to learn the 2024 deadlines for various tax-related forms and payments.

Posted on January 19, 2024

Businesses that file 10 or more information returns must now file them electronically.