Eligible businesses affected by the COVID-19 pandemic now have until May 31 to apply for a PPP loan. Here’s the latest on the popular loan program.

Posted on March 31, 2021 by CD Bradshaw & Associates, P.C.

Eligible businesses affected by the COVID-19 pandemic now have until May 31 to apply for a PPP loan. Here’s the latest on the popular loan program.

Posted on March 23, 2021 by CD Bradshaw & Associates, P.C.

Is your business taking full advantage of the Employee Retention Credit?

Posted on March 23, 2021 by CD Bradshaw & Associates, P.C.

The Paycheck Protection Program has undergone some notable changes recently as the Small Business Administration and Biden administration seek to give very small businesses easier access to loan funds.

Posted on March 22, 2021 by CD Bradshaw & Associates, P.C.

Due to the pandemic and an unprecedented backlog of tax returns waiting to be processed, the IRS has postponed the federal tax filing deadline to May 17, 2021.

Posted on March 18, 2021 by CD Bradshaw & Associates, P.C.

Because the American Rescue Plan Act is such an expansive piece of legislation, it’s likely you, your family or your business can benefit from it.

Posted on March 16, 2021 by CD Bradshaw & Associates, P.C.

The Work Opportunity Tax credit was set to expire on Dec. 31, 2020. But a law passed late last year extends it through Dec. 31, 2025. Here’s how employers can benefit if they’re hiring.

Posted on March 12, 2021 by CD Bradshaw & Associates, P.C.

The latest COVID-19-related stimulus bill, the American Rescue Plan Act, has now passed. How can you benefit?

Posted on March 3, 2021 by CD Bradshaw & Associates, P.C.

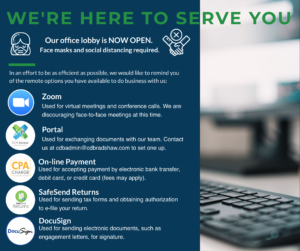

It has been almost a year now since COVID-19 began changing our lives and we wanted to update you on how CD Bradshaw & Associates, P.C. is continuing to serve you and our community.

Posted on March 2, 2021 by CD Bradshaw & Associates, P.C.

The Biden Administration has announced five specific reforms to the Paycheck Protection Program that are intended to benefit small businesses.