There are several options for operating your small business. For example, a sole proprietorship, an S corporation or a partnership. Take a look at why a limited liability company (LLC) might be right for you.

Posted on August 10, 2021 by CD Bradshaw & Associates, P.C.

There are several options for operating your small business. For example, a sole proprietorship, an S corporation or a partnership. Take a look at why a limited liability company (LLC) might be right for you.

Posted on August 5, 2021 by CD Bradshaw & Associates, P.C.

The SBA has eased the process of forgiving a PPP loan. Here’s how.

Posted on August 5, 2021 by CD Bradshaw & Associates, P.C.

For any business large or small, strategic planning is no joke. Here are some best practices for holding meetings that produce exciting ideas for a profitable future.

Posted on July 26, 2021 by CD Bradshaw & Associates, P.C.

If you received a PPP loan, important forgiveness deadlines are approaching. Are you ready?

Posted on July 6, 2021 by CD Bradshaw & Associates, P.C.

If your business hasn’t already claimed the Employee Retention Tax Credit, you should check out if you’re eligible. The money can help with the costs you incur in hiring and retaining employees during the pandemic.

Posted on June 30, 2021 by CD Bradshaw & Associates, P.C.

If you have children age 17 or under, it’s critical to understand the recent changes made to the child tax credit.

Posted on June 22, 2021 by CD Bradshaw & Associates, P.C.

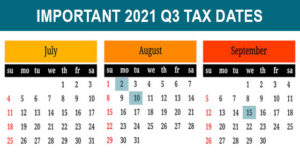

Although you might want to enjoy the lazy days of summer, employers and businesses should be careful not to miss these third quarter 2021 tax deadlines.

Posted on June 2, 2021 by CD Bradshaw & Associates, P.C.

About 39 million households covering 88% of children in the U.S. will begin receiving monthly tax credit payments soon. Here are the details.

Posted on May 26, 2021 by CD Bradshaw & Associates, P.C.

Congratulations if you filed your 2020 tax return by the May 17 deadline. But you may still have questions. We’re often asked about refund status, record retention and amended tax returns. Here are some answers.