Many small businesses operate as sole proprietorships. Here are eight tax issues involved in operating as this entity.

Posted on February 15, 2022

Many small businesses operate as sole proprietorships. Here are eight tax issues involved in operating as this entity.

Posted on January 25, 2022

How much can your employees contribute to 401(k) plans this year? How much will your business be able to deduct for business meals, driving expenses and equipment in 2022? Here are the answers to these and other questions about tax inflation adjusted amounts and other changes affecting businesses.

Posted on December 31, 2021

Businesses face a variety of tax-related deadlines in the first quarter of 2022. Here are some of them.

Posted on November 30, 2021

The sun has set on the valuable Employee Retention Credit. Here’s what happened.

Posted on October 12, 2021

With fall foliage here in many areas, it’s time for businesses to start thinking about year-end tax strategies. It’s also time to think about the fourth quarter 2021 tax filing deadlines.

Posted on September 13, 2021

Before Dec. 31, you may want to make some tax moves to save on 2021 taxes. Here are a few strategies.

Posted on August 10, 2021

There are several options for operating your small business. For example, a sole proprietorship, an S corporation or a partnership. Take a look at why a limited liability company (LLC) might be right for you.

Posted on July 6, 2021

If your business hasn’t already claimed the Employee Retention Tax Credit, you should check out if you’re eligible. The money can help with the costs you incur in hiring and retaining employees during the pandemic.

Posted on June 22, 2021

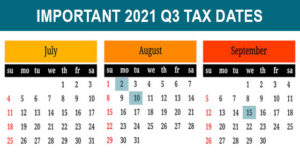

Although you might want to enjoy the lazy days of summer, employers and businesses should be careful not to miss these third quarter 2021 tax deadlines.