You can operate your small business in several ways. For example, your entity can be a sole proprietorship, an S corporation or a partnership. Here are the advantages of operating as a limited liability company (LLC).

Posted on August 9, 2023

You can operate your small business in several ways. For example, your entity can be a sole proprietorship, an S corporation or a partnership. Here are the advantages of operating as a limited liability company (LLC).

Posted on July 27, 2023

There may be a way to reduce a large tax bill if you own appreciated land that you want to subdivide and develop for sale. Here’s a three-step strategy.

Posted on July 24, 2023

When spending money personally on behalf of your closely held corporation, you want to ensure the expenses are tax deductible by either you or the business. Here are the key considerations.

Posted on June 28, 2023

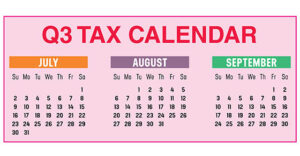

You might want to enjoy the lazy days of summer, but employers and businesses need to make sure not to miss these third-quarter 2023 tax deadlines.

Posted on June 12, 2023

Here’s a rundown of the tax deductions you can claim for business travel.

Posted on June 7, 2023

Keeping careful business records for meal and vehicle expenses can safeguard your tax deductions. Here are some DOs and DON’Ts.

Posted on May 30, 2023

Does your business provide Health Savings Accounts (HSAs) to employees? The IRS has announced the inflation-adjusted amounts for 2024. Here they are, along with the benefits of HSAs

Posted on May 25, 2023

These days, many businesses are filling vacant positions and saving money by using independent contractors. Here are the basic rules to help keep you out of trouble with the IRS.

Posted on April 6, 2023

There are several choices of entities for a new business venture. What about an S corporation? Here are the advantages.