Summer is here and tax deadlines are probably the last thing on your mind. But there are some important third-quarter deadlines that businesses can’t afford to forget about.

Posted on June 27, 2024

Summer is here and tax deadlines are probably the last thing on your mind. But there are some important third-quarter deadlines that businesses can’t afford to forget about.

Posted on June 25, 2024

Now is the time to get up to speed on 2024 SECURE 2.0 changes. Here are several to consider.

Posted on June 19, 2024

There are several factors to consider when converting from a C corporation to an S corporation. Here are four of the tax issues you may face.

Posted on June 18, 2024

The Tax Cuts and Jobs Act (TCJA) was signed into law in 2017 and generally took effect at the start of 2018. It brought sweeping changes to various aspects of tax law for both individuals and businesses. But many of its provisions aren’t permanent. In fact, some of…more

Posted on May 28, 2024

There are potential federal income tax advantages when you include debt in the capital structure of a C corporation. Here’s a rundown.

Posted on May 23, 2024

There are a number of different hobbies that some taxpayers turn into businesses. Here’s how they can protect tax breaks on their tax returns.

Posted on May 14, 2024

Construction projects don’t all look the same nowadays. One increasingly popular approach is offsite construction, and these jobs present distinctive project management challenges.

Posted on May 8, 2024

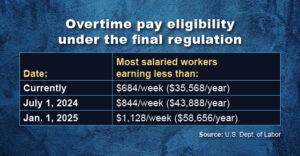

Two new federal rules regarding overtime pay and noncompete agreements have recently been adopted.

Posted on April 26, 2024

If you’ve inherited an IRA, you need to know about the latest IRS guidance.